By Zhang Boling

The recent release of the annual list of China’s top 500 Chinese enterprises not only highlights the increasing scale and quality of Chinese firms, but also the resilience and vitality of the country’s high-quality economic development.

For the 23rd consecutive year, the entry threshold for the list has risen. This year, 267 companies reported annual revenues exceeding 100 billion yuan ($14.04 billion), while 15 surpassed the 1 trillion yuan mark.

As primary economic actors, enterprises drive job creation, propel innovation, and shape industrial advancement. Serving as sector leaders, China’s top 500 enterprises function as a key indicator of broader economic performance.

What sets this year’s data apart? Three notable trends offer insight into the underlying momentum of China’s economic transformation.

China’s market vitality is reinforced by dual-engine growth from both state-owned and private enterprises.

Among the top 500 companies, ownership distribution shows near parity: 251 state-owned enterprises (SOEs) and 249 private firms. This equilibrium reflects the complementary strengths of both models and demonstrates China’s adherence to its established policy of “unswervingly consolidating and developing the public sector while actively encouraging, supporting and guiding the non-public sector.”

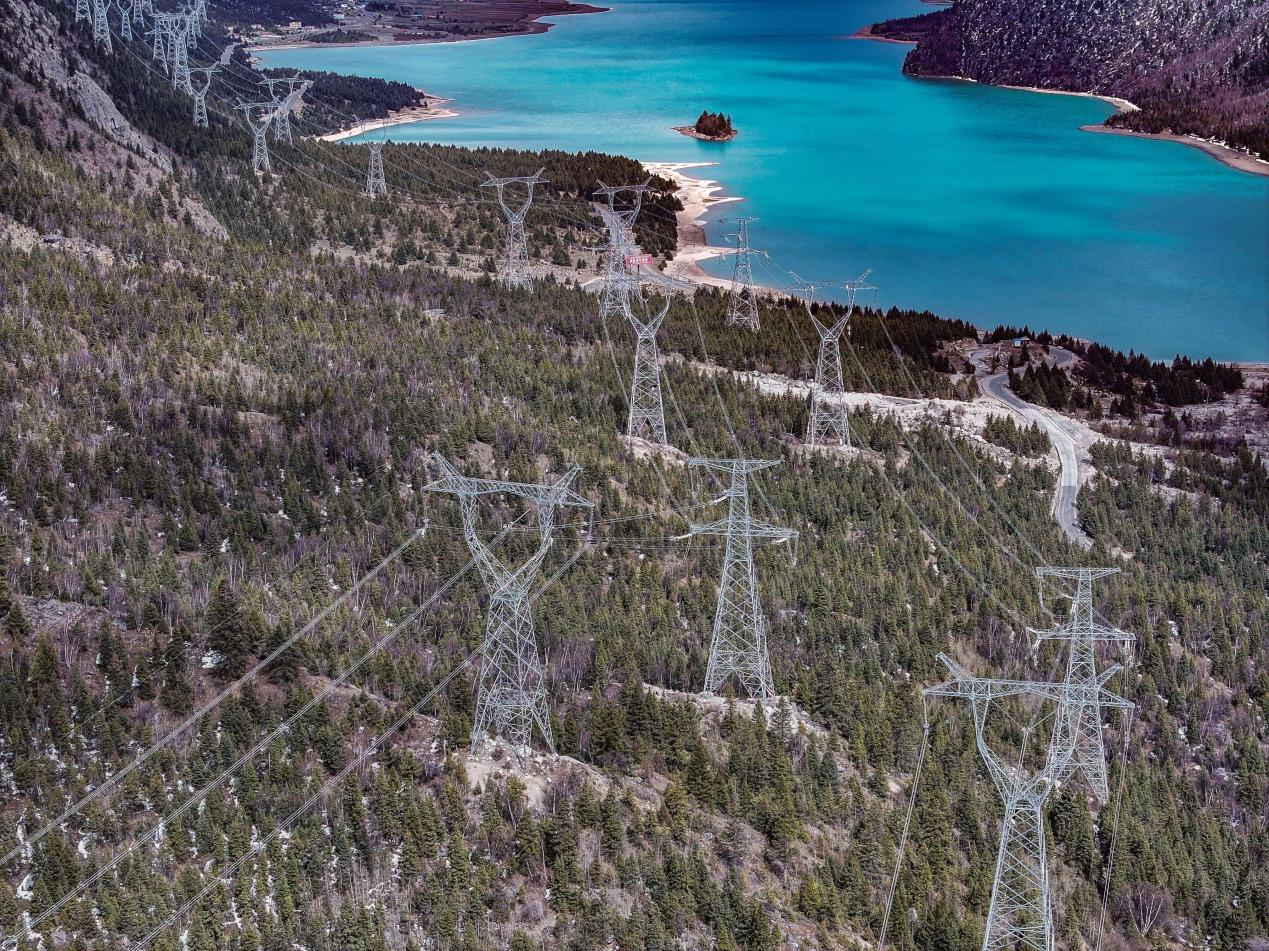

SOEs continue to drive strategic advancements: CRRC Corporation Limited pioneers high-end rail technology, with the CR450 trainset establishing new global benchmarks. State Grid Corporation of China is constructing next-generation power system to support the transition to renewable energy. These initiatives underscore the strategic role SOEs play in critical sectors tied to national development and public welfare.

Meanwhile, private enterprises are injecting vitality into emerging industries. Automakers like BYD are driving innovation and leading global new energy vehicle (NEV) sales, while internet technology companies are transforming consumer behavior and supply chain ecosystems through digital innovation. The collaborative and competitive dynamics between SOEs and private firms enhance China’s overall capacity for innovation and resilience.

Synergy between manufacturing and services is redefining industrial competitiveness in China.

Revenue data shows a balanced economic structure: manufacturing contributed 40.48 percent and services 40.29 percent to the total revenue of the top 500 enterprises. This near-parity debunks the traditional view that manufacturing and services compete for dominance, instead demonstrating how manufacturing provides the foundation while services enhance value.

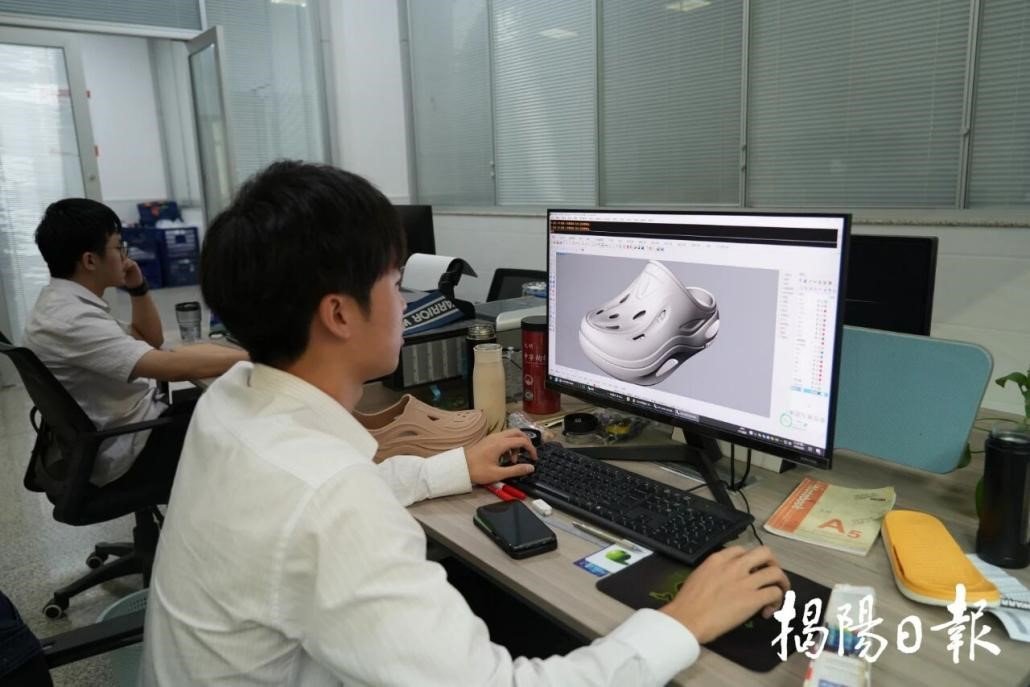

High-end equipment manufacturing has created demand for specialized services such as industrial design and operational management. Meanwhile, the booming NEV sector is fostering new business models in battery recycling and intelligent connectivity, opening a broad space for service-sector growth.

At the same time, digital technologies are accelerating the transformation of traditional manufacturing toward smart production. Supply chain finance is alleviating capital constraints for small and medium-sized enterprises, while upgraded logistics networks support lean operations and real-time delivery, enabling “zero inventory” manufacturing. The integration of manufacturing and services is creating a more efficient and globally competitive industrial system.

Coordinated domestic and international development expands growth potential.

The entry threshold for the 2025 list of the top 500 Chinese enterprises has risen by 11.76 percent from last year, while the overseas assets of listed companies reached 11.96 trillion yuan. The steadily rising transnational index of these firms, combined with solid domestic performance, reflects a development model that balances strong domestic development with expanding overseas presence.

Chinese companies are no longer simply exporting products but exporting value by embedding themselves deeper into global industrial chains. Smartphone manufacturers such as VIVO and Transsion have established significant market shares in emerging markets. This international expansion strengthens domestic development by building more resilient supply chains and enhancing industrial competitiveness.

This dual approach – anchored in domestic stability and bolstered by global engagement – enables Chinese enterprises to maintain strategic momentum amid global uncertainties.

From the complementary roles of public and private enterprises, to the convergence of manufacturing and services, and the interplay between domestic strength and international expansion, China’s top enterprises are powering the country’s economic transformation.

Looking ahead, continued optimization of resource allocation and stronger collaborative innovation will further empower Chinese companies to grow and lead industrial transformation, driving China’s economy steadily along the path of high-quality development.